year end accounts deadline

Section 3 and 4 of the Companies Miscellaneous Provisions Act 2013 commenced on Monday 10th March 2014. It is also known as an accounting reference date for limited companies.

Traders Should Consider Section 475 Election By The Tax Deadline

The deadline to process PCard transactions journals accounting adjustments travel requisitions and PAAs is June 15 2020 so that Sponsored Projects has sufficient time to process the final invoice after July 10 2020 when the classified.

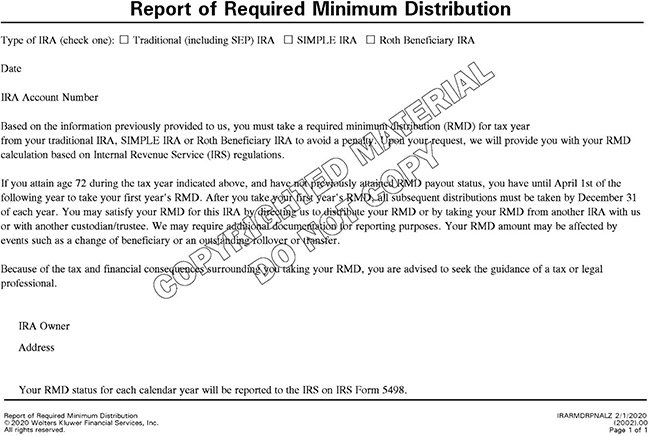

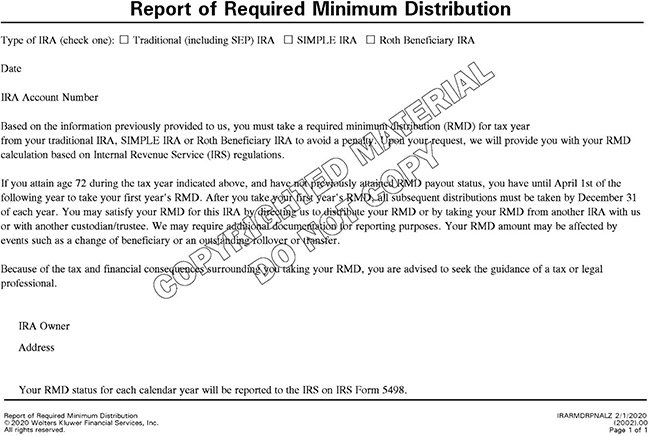

. Take required minimum distributions. Procurement card post-back period end last day procurement card transactions can be posted to FY 2021. Year-end refers to the end of your companys accounting period.

The automatic extensions granted by the Corporate Insolvency and Governance Act will come to an end for filing deadlines that fall after 5 April 2021. Deadline to submit all 2019 activity to post in 2019. Wednesday Auxiliary Voucher AV for FY 2021.

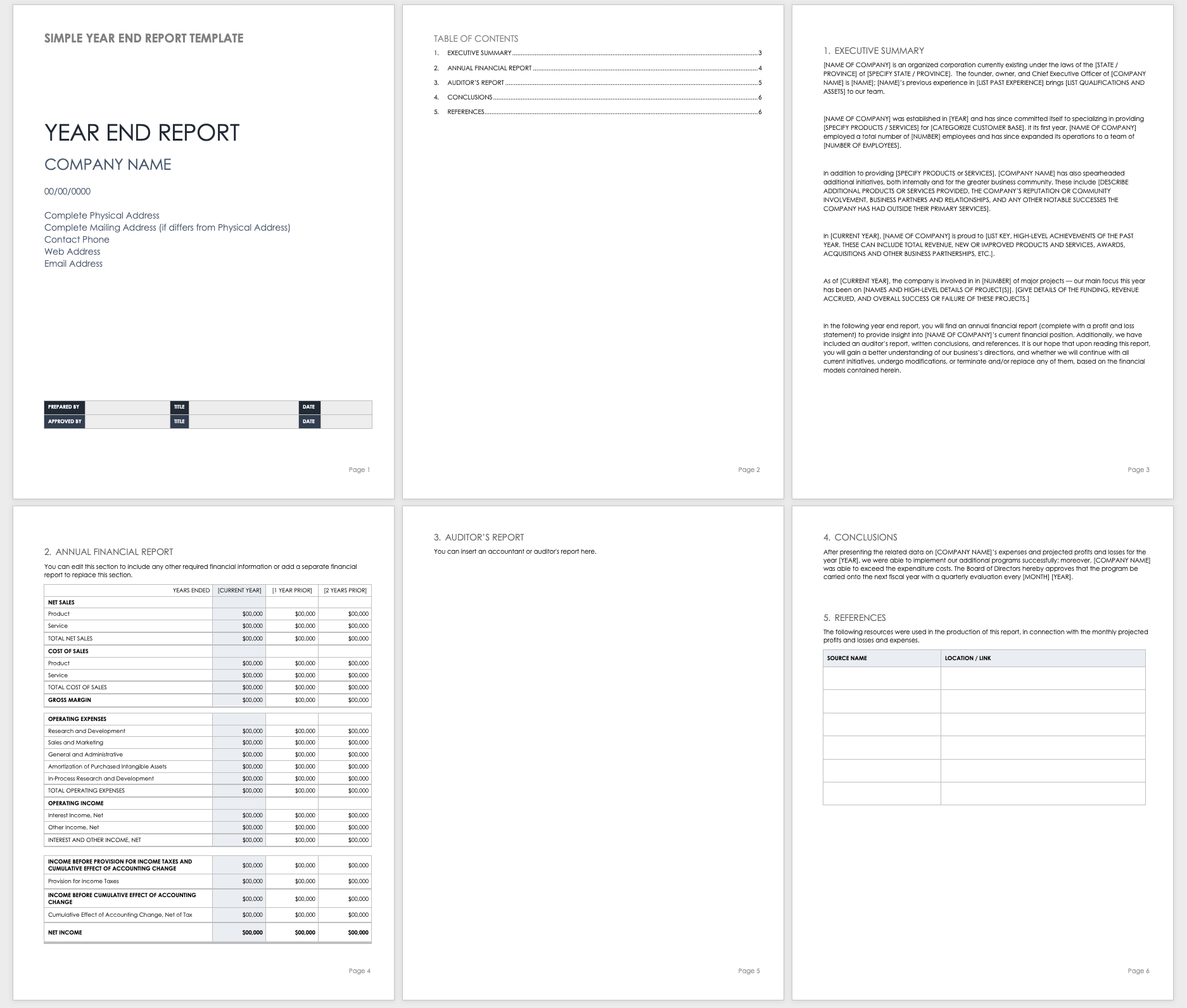

Filing Company Year End Accounts with HMRC. The process of closing the books for fiscal year 2022 will soon be underway. For most businesses this will be the same as their calendar year.

The time allowed for delivering accounts is 9 months from the accounting reference date. You will also need to file a directors report unless your company is a micro-entity. Remember these year-end retirement account deadlines.

21 months after the date you registered with. 31 2020 will be reflected in your 2020 budget. For example companies with a 31st December 2020 year end will have to file their accounts by 30th September 2021.

Accounts Payable AP including Non-employee reimbursements Initial AP Cut-off. You will need to file your company tax return also known as the CT600 form online. FY22 BPAs received after 630 deadline5.

10-14 2020 Division Accounting will provide final draft Year-End 2019 Financial Reports. -- Qualify for the savers credit. What You Need to Send.

Contact Division Accounting ASAP to discuss edits or questions. The deadline to pay your Corporation Tax bill is 9 months and 1 day after the end of your accounting period for your previous financial year. Year End Closing Procedures and Deadlines.

Each year finance professionals bury their heads in the books to prepare their end-of-year accounts statements and financial reporting. Reporting questions Contact UIS helpdesk at 6-2001 to open a ticket. Closing Deadlines and Submission Information.

BPAs received by 6305. -- Contribute to your 401 k plan by Dec. There are a few key changes to this years calendar including MN113021 pull deadline is 112421 and the first biweekly payroll in 2022 BW122521 uploads due 1422 which will process the same day.

You can apply for more time to file if something has happened that is out of your control and you cannot file your company accounts on time. We will not issue you a late filing penalty if. Published November 18 2021.

If the vendor invoice is July 1 or later it will post to the new fiscal year. FY21 invoices submitted by 5pm Thursday 617 will be posted to the GL by COB Thursday 624. You must send your application to us before your normal filing deadline.

So if your companys financial year-end is 30th June you would need to complete your accounts by 30th June of the following year. This is when you close your accounting period for the financial year and file the statutory year-end accounts with HMRC and Companies House. -- Donate your IRA distribution to charity.

-- Take required minimum distributions. Heres how to maximize the value of your retirement accounts before the end of the year. 3rd - Deadline for submitting P46 for employees whose carfuel benefits changed during the quarter to 5th July 2022.

Contribute to your 401 k plan by Dec. Its estimated that the average accounting team takes 25 days to complete an annual close. The end of the year is approaching and that means many will be finalizing various transactions such as contributions withdrawals and investment changes to your Virginia529 account.

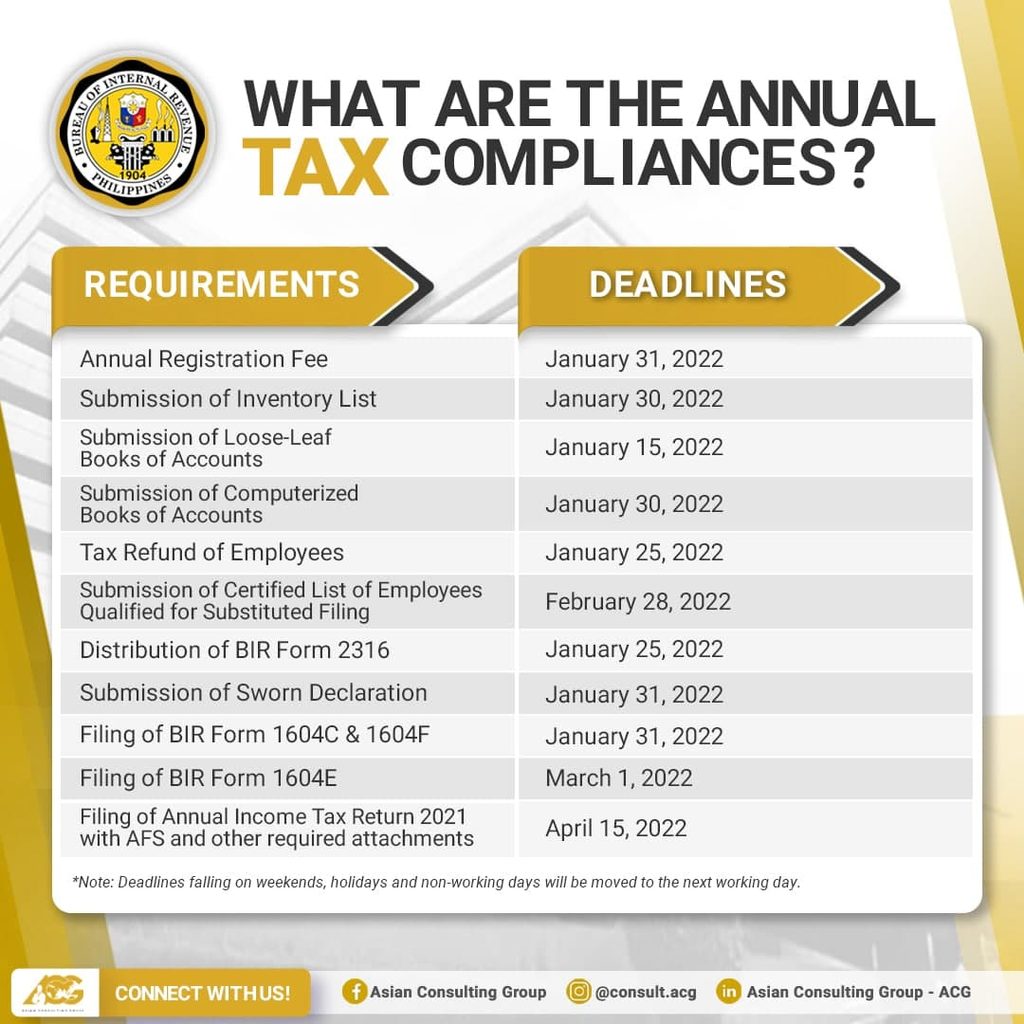

However theres an option to pay the renewal registrations quarterly which is due 20 days after the close of the quarter April 20 July 20 and October 20. Donate your IRA distribution to. Key closing dates and important deadlines are outlined below.

The deadline for completing accounts year-end is usually 12 months after your companys financial year-end. This session will review Virginia529s holiday schedule and provide helpful tips to ensure your transactions are processed to meet any year-end deadlines. 7th - Deadline for VAT Returns and payments of.

Thursday 617 at 5pm. 1st - Due date for payment of Corporation Tax for period ended 31st October 2021. Year-end is fast approaching and its time to start planning for the successful wrap-up of 2021 payroll.

Remember these year-end retirement account deadlines. For existing companies it will be the anniversary of the day after the previous financial year ended. Deadline of Annual Payment of Business Registrations Renewal is January 20.

To do this you will need your company accounts and your corporation tax calculation. The end of the fiscal year is a critical time for finance teams. It should include a full explanation of why you need the extension.

Data available to Tubs on Friday morning 625 in HDW. Depending on the size of your company you. Any 2019 revenues andor expenses submitted after Jan.

October 19 2021 by Employee Services. The accounts can actually be filed up to 11 months after the financial year end if the electronic filing procedure is maximised. The CRO has now made it possible for both the annual return and accounts to be filed electronically.

For example if your accounting period ends on 31st of March your Corporation Tax deadline is 1st of January. Your year-end accounts are due at Companies House 9 months and 1 day after your financial year end. Monday First account reversion.

File first accounts with Companies House.

Individual Retirement Accounts Rmd Notice Deadline Approaching Wolters Kluwer

Year End Accounting Checklist How To Close The Fiscal Year

Ask The Tax Whiz What Are The Year End Requirements For Taxpayers

Free Year End Report Templates Smartsheet

Year End Accounting For Limited Companies Made Simple

Make Sure You Know Your Irs Tax Deadlines For Filing Your 2020 Business Taxes In 2021

12 Common Tax Myths Busted In 2022 Income Tax Return Tax Deadline Tax Return

Why And How To Choose A Financial Year End Date Fastlane

Solo 401k Contribution Limits And Types

When Are Taxes Due In 2022 Forbes Advisor

Make Sure You Know Your Irs Tax Deadlines For Filing Your 2020 Business Taxes In 2021

When And How To File Your Annual Accounts With Companies House Companies House

2021 401 K Deadlines For Plan Sponsors Guideline

Individual Retirement Accounts Rmd Notice Deadline Approaching Wolters Kluwer

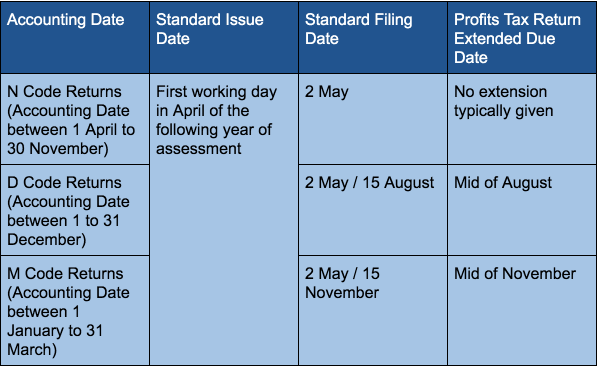

What Are The Two Options Singapore Companies Have When Filing Their Tax Returns What Is The Difference Between Form C And Fo Tax Return Filing Taxes Singapore

Tax Tip Don T Forget Subsequent Required Minimum Distributions Are Due Tas

:max_bytes(150000):strip_icc()/ScreenShot2021-09-18at11.10.03AM-241ecfcb218d46bdbb4b16a285992b69.png)

/ScreenShot2021-09-18at11.10.03AM-241ecfcb218d46bdbb4b16a285992b69.png)